Despite the fact that the crypto market is quite volatile, the world has recently discovered that the cryptocurrency market can be rather lucrative. That is, of course, if you play your cards right. Many investors have generated millions of dollars by being smart with their money and getting into the market at the right time.

The crypto market has had a wild couple of years. The path to becoming a crypto millionaire, let alone a crypto billionaire, is likely stressful, filled with danger, yet incredibly profitable. While the bear market has taken its toll over most of 2022, there are still millions of people who are still incredibly profitable. There are various crypto billionaires in existence and we can only expect many more when the market recovers.

In this article, RR² Capital outlines the top 5 crypto billionaires of 2022:

What Is A Crypto Billionaire?

A person is considered to be a crypto billionaire if they have either amassed billions of dollars through investing in cryptocurrencies or have established successful crypto-related businesses that are now worth billions of dollars. Since the crypto market is still relatively new, there is also the possibility that crypto billionaires achieved their fortune through a combination of investing or through crypto companies.

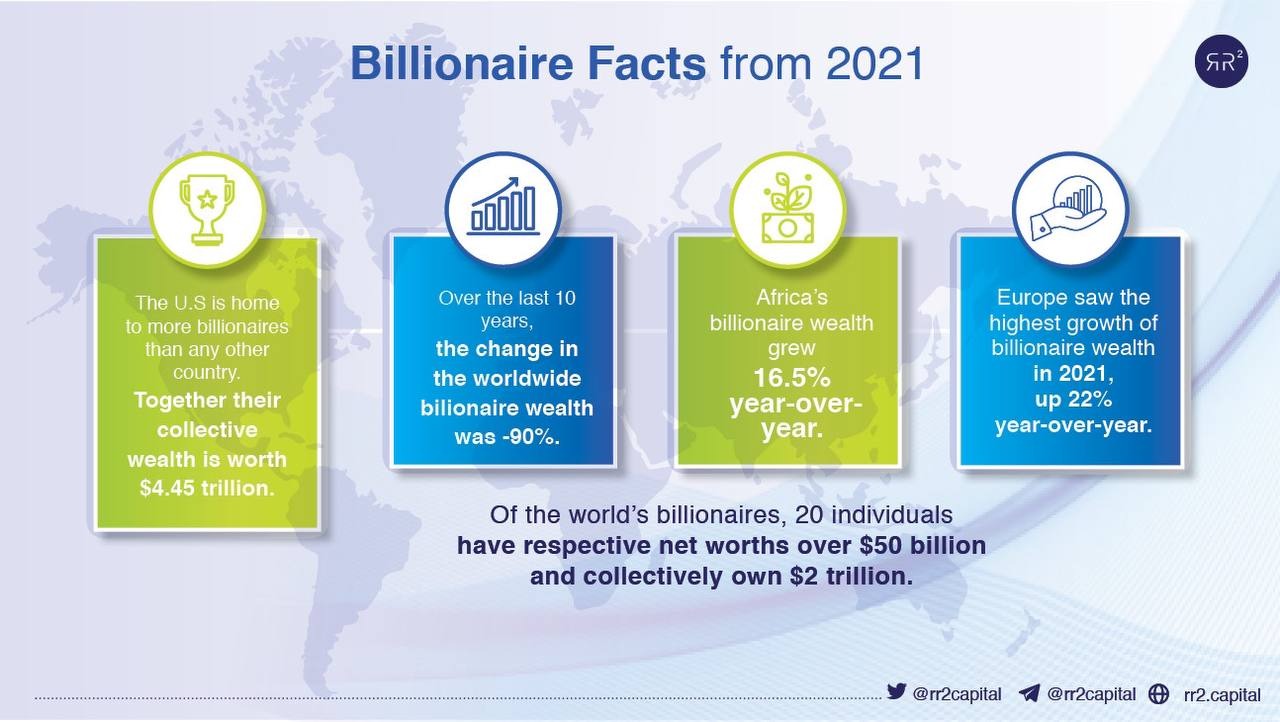

How Many Crypto Billionaires Are There?

As mentioned earlier, the crypto market is still relatively young. This means that there are still only a small number of people who have made it to billionaire status through cryptocurrencies. At present, there are a total of 19 crypto billionaires in the world. While it is certain that this number is set to increase over the coming years, it still remains a mystery as to whether the name “Satoshi Nakamoto” will ever feature on this list of billionaires.

Who Are The Top 5 Crypto Billionaires In 2022

Changpeng Zhao (CZ) – $65 Billion

Changpeng Zhao (CZ) is a Chinese-Canadian businessman. He is the founder and Chief Executive Officer (CEO) of the world’s largest cryptocurrency exchange by trading volume, Binance. According to the Bloomberg Billionaires Index, in January 2022, CZ’s net worth was $96 billion, surpassing the likes of Mark Zuckerberg at the time and making him the world’s richest crypto billionaire.

Due to bear market conditions, however, CZ’s fortune has decreased somewhat to $65 billion, still not low enough to knock him off the top spot though. Cz is not only a crypto billionaire, but he’s also one of the world’s wealthiest individuals.

Zhao emigrated to Canada from China when he was 13 years old. He became interested in Bitcoin while playing poker with some friends. CZ’s interest peaked in 2014 when he put all of his money into cryptocurrencies and even sold the flat he was living in to buy Bitcoin.

In 2017, CZ then founded Binanace which has approximately 30 million users. CZ reportedly owns at least 70% of Binance. Binance boasts an incredible offering of over 600 cryptocurrencies for users to buy, sell and trade, including its native token, BNB. According to data from various sources, Binance generated roughly $20 billion in 2021.

CZ, however, seems rather unfazed about his number one position on the crypto billionaire list. CZ reportedly told Bloomberg that he didn’t care much for wealth, money and rankings and that he would be prepared to give most of his wealth away before he passes away.

Sam Bankman-Fried (SBF) – $24 Billion

Sam-Bankman Fried, also known as SBF, is the co-founder and CEO of crypto exchange FTX. SBF boasts an estimated net worth of $24 billion.

The rise of Sam Bankman-Fried to the status of crypto industry billionaire has been rapid to say the least. While still a student at Massachusetts Institute of Technology (MIT), SBF was an intern at Jane Street Capital, a proprietary trading firm. After completing his degree, he started working there full-time. In 2017, he founded a quantitative trading firm called Almeda Research, which he currently owns 90% of. He then founded FTX in 2019.

FTX offers innovative products including industry-first derivatives, options, volatility products and leveraged tokens. It also provides spot markets in over 100 cryptocurrency trading pairs, including its native token FTT. FTX averages around $10 billion in daily trading volume and has over one million users.

Much like CZ, Sam Bankman-Fried doesn’t care much for his wealth. He only wants his wealth to survive long enough so he can give it all away.

Brian Armstrong – $6.6 Billion

Brian Armstrong is the co-founder of Coinbase, the first cryptocurrency exchange to go public on the Nasdaq Stock Market in 2021. Armstrong, a former software engineer at Airbnb, founded the trading platform in 2012 with Fred Ehrsam. Armstrong has a 19% stake in Coinbase and is estimated to be worth $6.6 billion

Coinbase has approximately 103 million verified users, 14,500 institutions, and 245,000 ecosystem partners in over 100 countries. Coinbase has an intuitive user interface. For beginners, it’s a relatively easy to use platform to make crypto purchases.

Gary Wang – $5.9 Billion

Gary Wang is the co-founder and Chief Technology Officer (CTO) of crypto exchange, FTX. Both Bankman-Fried and Wang founded FTX in 2019. Wang owns a 16 percent share in the crypto exchange and as a result is worth approximately $5.9 billion.

Wang appears to be press-shy and doesn’t appear much in the media, this is why many people may not recognise his name.

In addition to having a 16 percent share FTX, Wang is the owner of more than $600 million worth of FTT, which is the FTX native coin. Before entering the cryptocurrency market, Wang worked as a software engineer for Google, where he contributed to the development of the online travel agency Google Flights. After leaving Google, Wang began working in the cryptocurrency industry, which is where he has generated his wealth.

Tyler and Cameron Winklevoss – $5 billion each

Tyler and Cameron Winklevoss, the twin brothers best known for being Mark Zuckerberg’s college rivals (as shown in the Hollywood film The Social Network), have converted the $65 million settlement they reached with Zuck into billions, joining the Bitcoin billionaires list. The Winklevoss twins are worth approximately $5 billion each.

The Winklevoss twins reportedly began buying Bitcoin in 2012. The twins then went on to launch crypto exchange, Gemini. Gemini allows users to buy, sell, and store cryptocurrencies. The exchange was valued at $7 billion after its $400 million fundraising in November 2021.

The Winklevoss twins also own Nifty Gateway, a platform to buy and sell Non-Fungible Tokens (NFTs).

How To Live Off Crypto From Anywhere in the World

Many people have the ultimate goal is to be able to support themselves solely through cryptocurrencies. At some time in our lives, almost certainly all of us harbor the sincere desire to reach a place when we are no longer concerned about our next paycheck. Cryptocurrencies do, however, have the potential to make this a reality for many. While it may be difficult to become a crypto billionaire, it doesn’t stop us from genuinely wondering about whether or not it’s even possible to live off crypto.

It’s not unheard of for people to live comfortably off of their gains from the stock market, the same should be true for crypto investors. It is, however, highly improbable that you will go from living in poverty to being filthy rich overnight.

Where’s The Best Place To Live Off Crypto?

It is necessary to spend a significant amount of time thinking about where you want to live if you intend to live off crypto. This is largely due to the fact that crypto can go a little bit further in certain regions. For example, in countries where the taxation and legislation may not be as stringent.

If you’re sold on the idea of living solely off crypto, you may have to ask yourself some tough questions like: are you going to have to convert your cryptocurrency to fiat currency in order to pay for the everyday essentials? When planning to only pay using bitcoin, it can be challenging to fund expenses such as rent, food, and gas. Unless you reside in a city that supports cryptocurrency, which, as it turns out, is not the case as of yet. Some cities are, however, more suited to enable you to live off crypto.

Unfortunately, the majority of cryptocurrency-friendly locations tend to either have a high cost of living or have strict legislation regarding cryptocurrencies and tax systems that are not favorable. These factors can make living off crypto more difficult.

The Top Countries To Live Off Crypto

If you’re looking for the best country to live off crypto then you’ll likely want to explore the following countries:

Andorra

Andorra is a microstate located between France and Spain. The region is most commonly known for its tax-haven status. You’ll be glad to know that Andorra is considered to be one of the most crypto tax-friendly countries in the world. There are also various stores in the country where you can pay for items using cryptocurrency. When it comes to taxation in Andorra, both corporate tax and personal income tax is capped at 10%, this means that you will not pay more than 10% profit on your crypto profits.

According to research published by the World Bank, this Principality has one of the lowest crime rates in the entire world, placing it as the fifth safest country in the entire world. Andorra has a low crime rate, nature, a strategic geographical location, climate, and gastronomy, but the cheap taxes are the country’s greatest selling point.

- Corporate taxes: The maximum rate of this tax is 10% for all companies created in Andorra.

- Personal Income Tax: This tax also has a maximum rate of 10%. However, it must be taken into account that the first €24,000 are exempted, the following €16,000 are taxed at a rate of 5% and the rest at 10%.

- Dividends obtained by Andorran companies to Andorran residents are totally tax exempt.

- VAT is 4.5%, the lowest in Europe.

As for the blockchain sector, Andorra is in favor of the use of new technologies and there is already regulation in this regard.

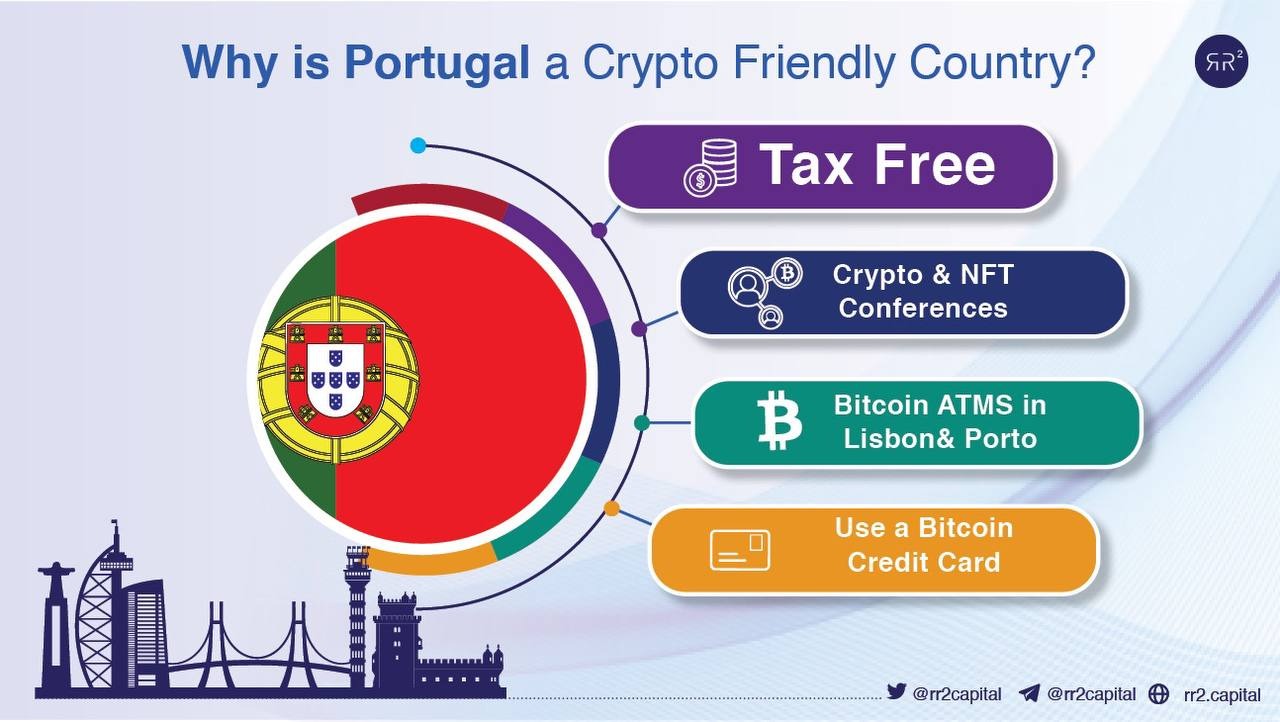

Portugal

The tax system in Portugal is often regarded as being among the most cryptocurrency-friendly in the world. Portugal is an excellent choice for you if you want to minimize the taxes that you pay on your Bitcoin holdings.

Since 2018, the total proceeds from the sale of cryptocurrencies have been completely exempt from taxation. You’ll also be relieved to learn that trading cryptocurrencies is also exempt from taxes.

As long as you are not operating a business in Portugal, the value added tax (VAT) and income tax that would normally apply to your cryptocurrency holdings do not apply. This means that individuals do not have to pay any taxes on any income they make from crypto investments.

Crypto regulation, however, could change in the near future. We’ll be keeping an eye out for any developments.

Why Do People Invest In Crypto?

Why do people buy crypto? Well.. The majority of the time, it’s not because they believe traditional currencies are going to be rendered obsolete by digital ones. There are, however, other reasons, including:

To Make Money

The reality is that the vast majority of people purchase cryptocurrencies with the hope of increasing their wealth. The crypto market is notoriously volatile, many investors see this as an opportunity to make a quick buck.

As A Hedge Against Inflation

Crypto investors believe that cryptocurrencies will gain value long-term because their supply is fixed, unlike that of fiat currencies such as the U.S. dollar. The supply of Bitcoin, for example, is capped at roughly 21 million. Most fiat currencies, however, can be printed at the will of governments and central banks. Investors believe that Bitcoin and other cryptocurrencies will gain value as fiat currencies depreciate.

Fear Of Missing Out (FOMO)

People are excited by new technology. Investors look for opportunities to invest in new tech that has the ability to drastically change peoples lives for the better. Many high-profile investors are calling for the price of Bitcoin to reach $100,000 per coin over the decade. With many large financial institutions starting to adopt cryptocurrencies, people don’t want to miss out on the opportunity to get in early.

Top Tips For Investing In Crypto Assets

Do Your Own Research (DYOR)

Doing your own research is your best bet when it comes to investing in cryptocurrencies. There is no doubt that this is the best thing you can do. You’ll not only learn about the project, but you’ll also gain valuable insights regarding the road map and the tokenomics. This will enable you to decide for yourself if the project is worth investing in. Relying on nebulous websites or crypto influencers motivated by their own self-interest could potentially lead to bad investment choices. That is why you should always DYOR!

It is essential for an investor in cryptocurrencies to keep a close eye on the state of the cryptocurrency market on a regular basis. The majority of individuals accomplish this through reading trustworthy publications that cover cryptocurrency, such as CoinDesk, Cointelegraph or Decrypt.

Never Risk More Than You Can Afford To Lose

There is one golden rule that you should always follow when it comes to investing, and that rule is this: Never risk more money than you can afford to lose.

It is always recommended by seasoned investors that newbie investors or traders should begin their trading careers with a small amount of capital. When it comes to crypto, investors often tend to get FOMO, risking more than they can afford to.

The crypto market is notoriously volatile. This means they carry a higher risk than purchasing traditional stocks. You should never do things like raise your mortgage or use your credit card to purchase crypto because you feel the price may go up. You could land yourself in serious debt if you risk more money than you can afford to lose.

Know When To Take Profit

If you want to be a profitable crypto investor, you need to know when to take profit. If you never take profit, you will never become a profitable investor. If you wish to call yourself a profitable investor, you’ll need to take profit at some point. Yes, holding on to an investment long-term is the best thing you can do, especially in the crypto market as this will limit your exposure to volatility. If, however, you never sell your holdings for a profit, you will never see the fruits of your labor.

The exciting aspect of trading cryptocurrencies is that, due to the volatility of the market, traders have the opportunity to make substantial profits in a relatively short amount of time. Taking a profit allows you to remove yourself from the market, which protects your investment gains from losses. On the other hand, if you do not take profit when you should, a reversal may occur, causing you to incur a loss even though you were previously making a profit.

Reinvest Your Profits

You’ve done the right thing and taken profit at your desired price, but now what do you do with the profits? Reinvesting your profits at a later stage could be beneficial.

With your profits from a previous investment, there is, of course, a great opportunity to reinvest and make even more money in the future. It is, however, important to remember that cryptocurrencies carry a high level of risk, there is no guarantee that you will not lose the money you invest.

Removing Your Initial Investment

Removing your initial investment is also a great strategy, as this removes the risk associated with an investment. Once you remove your initial investment, it won’t matter which way the market moves, because you will technically never suffer a loss.This is because any losses will not have an effect on the one’s initial capital.

For example, if you purchased $5,000 worth Bitcoin. A few months later, the price increases and your BTC holdings are now worth $10,000. You then sell your initial investment worth $5,000, leaving the remaining $5,000 in the market until some time in the future.

By taking out your initial investment, you’re not only protecting your capital, but you’re allowing your profit to potentially earn even more by leaving it exposed to the market, risk free.

About RR² Capital

RR² Capital is a Lisbon-based Venture Capital (VC) firm empowering the ‘new internet’. RR² specializes in disruptive technology spaces such as decentralized ledger technology, Artificial Intelligence (AI), machine learning and digital assets. They believe that many traditional businesses and organizations will implement these technologies, adding immense value to the core of those businesses.

RR² Capital’s mission is to capture value by investing in early stage projects and teams who are leading innovation and disruption within the Web3 space. The team operates a strategy centered on a long-term vision, developing long standing relationships, utilizing trusted advisors in decision-making, building an integrated network of first-movers and instilling the trait of flexibility across its team.

This has positioned RR² Capital as experts in value creation, reporting 1,011% returns across a portfolio of more than 140 investments in 2022.

For more information about RR² Capital and our expansive disruptive technology-focussed investment portfolio, visit our website here or send us a mail here.

Follow RR² Capital on Twitter.