Understanding Bitcoin Quarterly Performance Cycles: Patterns and Predictions

Curious about Bitcoin’s performance each quarter? This article breaks down Bitcoin quarterly performance cycles using historical data and key metrics to uncover trends. Knowing these cycles can help you anticipate market shifts and make smarter investments. Let’s dive into Bitcoin’s quarterly patterns.

Key Takeaways

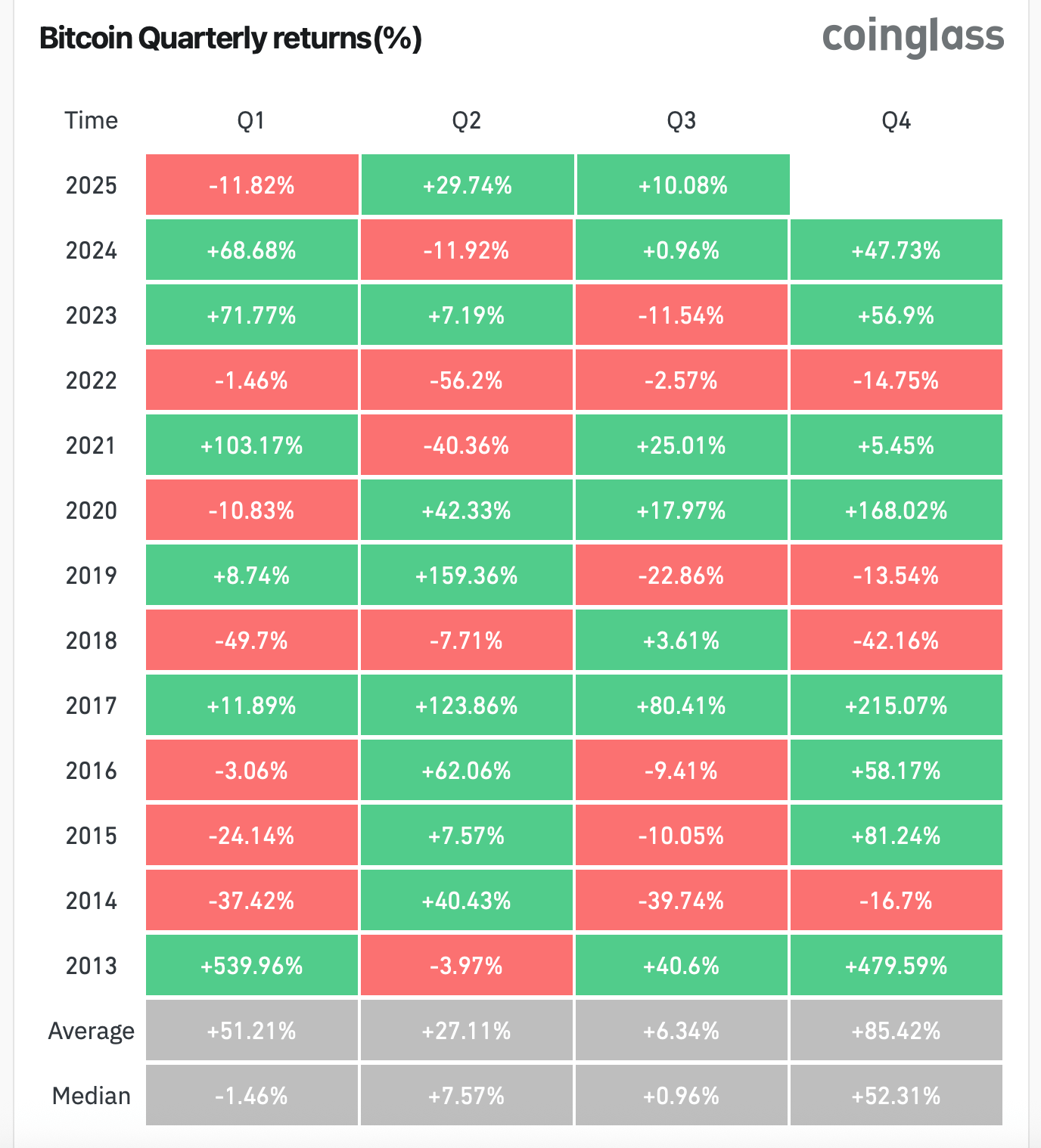

- Bitcoin exhibits considerable quarterly performance variability, with historical returns ranging from -45% to over 200%, highlighting the need for cautious and informed investment strategies.

- Key indicators like the 50-day EMA and RSI are crucial for predicting Bitcoin’s price movements, while halving events historically drive significant price increases, suggesting a predictable 4-year cycle.

- Macroeconomic factors, regulatory developments, and the behavior of long-term holders and whales greatly influence Bitcoin’s market dynamics, presenting both opportunities and risks for investors.

Bitcoin Quarterly Performance Overview

Bitcoin’s quarterly performance has shown significant variability, with average returns ranging from -45% to over 200% in different quarters across recent years. This high volatility is a double-edged sword, offering the potential for substantial gains but also posing significant risks. The observed average returns underscore the importance of cautious and informed engagement with Bitcoin. Investors must stay vigilant and adapt their strategies to the ever-changing market conditions, as the variability in quarterly performance can significantly impact investor strategies and market sentiment.

Understanding these trends is not just about looking back; it’s about using historical data to reflect on informed predictions about future movements. Recognizing quarterly patterns allows investors to better anticipate potential price fluctuations and make informed decisions.

We will delve into historical trends, key metrics, and notable movements for a comprehensive overview of Bitcoin’s quarterly performance.

Historical Quarterly Trends

Analyzing Bitcoin’s historical performance on a quarterly basis reveals significant insights into its price movements. For instance, key indicators such as the 50-day Exponential Moving Average (EMA) have proven vital in assessing Bitcoin’s quarterly performance. When Bitcoin’s price declines below this level, it often indicates a shift to a neutral trend, as observed when it fell below the 50-day EMA and horizontal support around $74K. Such trends are crucial for investors aiming to predict future price fluctuations in this volatile market.

Historians and analysts often look at these trends to understand the broader market developments. Studying these history patterns reveals significant variations in Bitcoin’s performance across different generations and decades, according to the historian.

This analysis is akin to how historians study past events, like the Vietnam War, to understand the present and predict future scenarios. Grasping these quarterly trends is a vital lesson for investors aiming to stay ahead and make informed decisions in the dynamic cryptocurrency market report.

Key Metrics and Indicators

Key metrics and indicators play a pivotal role in understanding Bitcoin’s quarterly performance. One such metric is the Relative Strength Index (RSI), which is currently indicating a neutral position at 40, suggesting market stability amidst volatility. The RSI on Bitcoin’s 4-hour chart also shows a neutral position at around 44.39, indicating potential volatility levels. Investors rely on these metrics to gauge market conditions and make informed trading decisions.

Additionally, trading volume and market capitalization are critical metrics that directly influence Bitcoin’s price movements and quarterly performance. The behavior of Bitcoin holders, whether they are long-term investors or short-term traders, significantly impacts these metrics.

These key indicators offer a clearer picture of potential future performance, aiding investors in navigating the complex world of Bitcoin trading.

Notable Quarterly Movements

Certain quarters have experienced drastic price changes, affecting overall market sentiment and investor behavior. These notable movements often coincide with significant developments in the cryptocurrency space, such as the introduction of spot Bitcoin ETFs or major regulatory announcements, marking a pivotal moment in the industry.

Analyzing these movements helps investors understand the factors driving Bitcoin’s price and anticipate future market shifts. Recognizing these patterns aids investors in making informed decisions and potentially capitalizing on significant price changes.

The 4-Year Cycle Theory

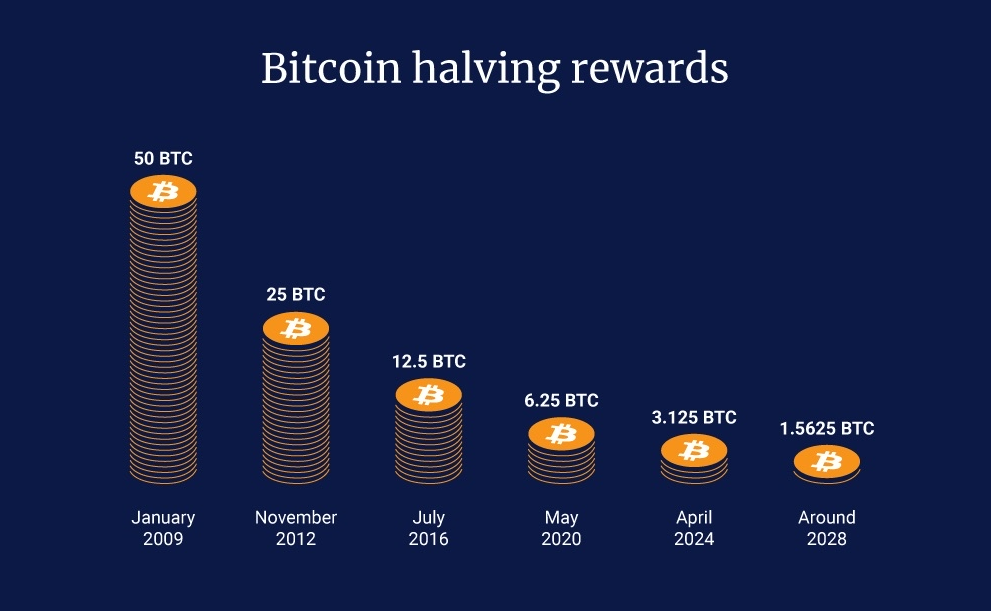

The 4-year cycle theory posits that Bitcoin experiences predictable price movements based on a cycle tied to its halving events. This theory is rooted in Bitcoin’s halving schedule, which fundamentally alters the supply of new bitcoins entering the market. The reduced supply, coupled with steady or increasing demand, often leads to significant price increases. The 4-year cycle theory suggests that these price movements follow a predictable pattern, influenced by supply changes and market demand.

Historically, Bitcoin’s price has shown significant fluctuations around these halving events, typically occurring every four years. These cycles offer a framework for predicting future price changes, giving long-term investors valuable insights.

We will explore the impact of halving events, compare past cycles, and analyze the current cycle, as some have argued, while also considering the perspectives of those arguing to provide a comprehensive understanding of this influential concept that has been discussed. Don’t forget the significance of these factors.

Halving Events and Their Impact

A Bitcoin halving event involves:

- Reducing the reward for mining new bitcoins by half, leading to a significant decrease in the creation of new bitcoins.

- Historical analysis revealing a pattern of price increases following each halving, although the timing and magnitude can vary.

- Bitcoin’s price typically reaching new highs approximately 12-18 months after halving events, reflecting the market’s adjustment to the reduced supply.

Each halving event has its unique market behaviors, but the general trend of price appreciation remains consistent. These events are critical milestones in Bitcoin’s lifecycle, often marking the beginning of new market phases.

Understanding the implications of halving events enables investors to better anticipate market movements and strategically position themselves for potential price increases.

Comparing Past Cycles

Comparing past cycles reveals significant patterns that can help predict future Bitcoin movements:

- Over the past decade, Bitcoin has experienced substantial quarterly fluctuations, with some quarters witnessing gains exceeding 200%.

- Quarterly performance has varied significantly, with Q2 often yielding the highest average returns over the years.

- Analysts have noted that Bitcoin tends to experience substantial price increases in Q2.

- In contrast, declines are often noted in Q3 during market corrections.

Bitcoin’s historical performance also indicates a tendency to stabilize around the 50-week EMA, which acts as a critical support level. Analysts predict significant fluctuations in price, with potential peaks and troughs based on historical cycles. Studying past cycles allows investors to identify similarities and differences, offering valuable insights into potential future market behaviors.

Current Cycle Analysis

The current cycle of Bitcoin is expected to maintain an upward trajectory as long as it stays above the 50-week EMA, currently near $100K. Experts forecast sustained growth in 2023, driven by increasing business acceptance and demand for Bitcoin ETFs. However, opinions on Bitcoin’s trajectory are divided, with some experts forecasting a bullish market driven by technological advancements and increased institutional adoption.

At the beginning of 2024, over 70% of Bitcoin was held for more than a year, indicating strong long-term investor confidence. This long-term holding pattern suggests a stable market foundation, potentially leading to continued price growth.

Analyzing the current cycle in the context of past performance helps investors make more informed decisions about their Bitcoin investments.

Bitcoin Technical Analysis for Q4 2025

Bitcoin’s price has recently shown recovery, bouncing back to around $113,800 after a dip below $108,000. Experts forecast that Bitcoin will likely experience significant fluctuations in price, with October 2025 possibly seeing values ranging from $108,269.91 to $123,848.69. This technical analysis offers insights into weekly chart trends and key technical indicators for Q4 2025.

Bitcoin has consistently held above the 50-week EMA for over two years, indicating a strong upward trend. Potential Fibonacci extension targets for Bitcoin’s current drop are $119K and $131K, suggesting possible resistance levels.

A move back below the 50-day EMA would suggest a neutral trend. This shift would also indicate a break of the horizontal support around $74K. We will explore these technical aspects in detail to provide a comprehensive analysis of Bitcoin’s potential scenarios for Q4 2025.

Weekly Chart Insights

Bitcoin’s price is currently fluctuating around a crucial support level of $110K. Key levels to watch include:

- Support at around $108K

- Resistance near $114K

- Key resistance on the BTC/USD weekly chart near $113.5K, which could be pivotal for Bitcoin’s price direction

These levels are critical for investors, as breaking through resistance could trigger significant upward movement at this wealth stage, assuming respect ability rise point.

The 14-week RSI has consistently remained above 45, indicating a potential continuation of the upward trend. Closely monitoring these weekly chart insights helps investors understand current market dynamics and make more informed trading decisions. The interplay between support and resistance levels will be crucial in determining Bitcoin’s price movements in Q4 2025.

Key Technical Indicators

Technical indicators play a crucial role in predicting Bitcoin’s future price movements. The weekly RSI for Bitcoin suggests potential for further upward movement, pending a defense of the current price range. These indicators offer insights into market trends and potential entry or exit points for traders. The Relative Strength Index (RSI) is a key technical indicator used to assess the momentum of Bitcoin’s price over a given period.

Analyzing these technical indicators provides a deeper understanding of Bitcoin’s market dynamics. This knowledge allows them to make more strategic decisions, whether they are looking to buy, hold, or sell. Monitoring these indicators will be essential for navigating the volatile market conditions expected in Q4 2025.

Potential Scenarios

Analysts predict the following for Bitcoin’s potential bullish trend:

- Reclaiming the $110,000 level may signal continuation of a bullish trend into Q4 2025.

- A bullish scenario requires breaking above the $114K resistance level.

- Breaking this resistance could initiate a rally towards $115K-$120K.

- Fibonacci extension levels of $119K and $131K are potential price targets for Bitcoin’s recovery.

However, there are also bearish scenarios to consider. If Bitcoin fails to maintain above the $110K level, it could lead to a worse fall downward trend, with potential support levels at $108K and below.

Investors must be prepared for various outcomes, as market conditions can change rapidly. Imagine understanding these potential scenarios presented helps investors better manage their risk and recognize the possibility of uncertainty fear making more informed decisions about futures in life.

Macroeconomic Factors Influencing Bitcoin

Macroeconomic factors significantly influence Bitcoin’s price and market performance. Bitcoin’s price volatility often leads to substantial fluctuations in market sentiment, making it challenging to anticipate its movements. The MVRV Z-score near 2.0 suggests that Bitcoin may be positioned away from a peak in its price cycle, indicating potential stability. This section will explore how global economic trends, regulatory developments, and institutional adoption impact Bitcoin’s price.

Trading volume serves as a critical indicator of market activity, often spiking during price surges or declines in Bitcoin’s quarterly performance. Investor sentiment can greatly affect Bitcoin’s price, with positive news typically leading to increased buying activity. Understanding these macroeconomic factors is key to predicting Bitcoin’s future performance and making informed investment decisions.

Global Economic Trends

Broader economic conditions such as inflation and interest rates can significantly affect Bitcoin’s price movements and market stability. Rising production costs, reflected in the Producer Price Index (PPI), can result in decreased investor confidence and negatively affect Bitcoin’s market performance. Fluctuations in the USD exchange rate also impact investors’ preferences for Bitcoin, with increases in the dollar often leading to reduced demand for cryptocurrencies.

Geopolitical tensions often result in heightened volatility in Bitcoin markets as investors seek alternative assets. These global economic trends play a crucial role in shaping Bitcoin’s price and trading volume, with geography influencing market dynamics, politics at play, and the international community involved in various countries. Staying informed about these trends helps investors navigate the complex and often unpredictable Bitcoin market.

Regulatory Developments

Regulatory developments have a profound impact on Bitcoin’s price and market dynamics. Specific events that have historically coincided with major price shifts in Bitcoin during certain quarters include:

- Regulatory news

- Technological advancements

- Announcements regarding the approval or rejection of Bitcoin ETFs, which can lead to significant price volatility and investor reactions.

The long-term perspective suggests that regulatory developments could stabilize the cryptocurrency market, but volatility is likely to persist. Major events, such as regulatory announcements and changes in legal frameworks, ultimately often trigger sharp price movements, reflecting the market’s sensitivity to legal and regulatory changes.

Understanding these dynamics is crucial for investors looking to anticipate market shifts and act strategically in their investment decisions.

Institutional Adoption

Institutional adoption plays a critical role in Bitcoin’s market stability and price growth. In the current cycle post-2024 halving, Bitcoin’s price growth appears more stable and driven by institutional investments compared to previous cycles. Increased investments from institutional players can drive significant price appreciation and enhance market credibility.

The entry of institutional investors has brought increased liquidity and stability to the Bitcoin market. Additionally, the development of new financial products, such as Bitcoin ETFs, has facilitated broader market access and attracted more investors. The establishment of clearer regulations around digital assets can also foster greater investor confidence, further driving institutional participation.

Recognizing the role of institutional adoption is vital for predicting future price movements and market trends, an idea that many analysts support.

Behavioral Patterns of Bitcoin Holders

The behavior of Bitcoin holders significantly influences its market performance. Long-term holders tend to retain their Bitcoin, which contributes to reduced supply and may lead to price appreciation. Positive market sentiment often correlates with increased buying activity, driving up Bitcoin prices during specific periods.

Whales, or large Bitcoin holders, can significantly influence market trends by executing large buy or sell orders. We will explore the behavioral patterns of Bitcoin holders, including long-term holders, short-term traders, and the impact of whale activity, to provide a comprehensive understanding of their market influence.

Long-Term Holders vs. Short-Term Traders

Long-term holders tend to exhibit less trading activity, contributing to price stability. These investors often hold onto their Bitcoin for extended periods, reducing the available supply and potentially leading to price appreciation. In contrast, short-term traders, particularly those who bought Bitcoin within the last 155 days, are often at greater risk of incurring losses during market downturns.

Past Bitcoin cycles demonstrate patterns of price surges followed by corrections, reflecting investor behavior and market dynamics. Understanding the differences between long-term holders and short-term traders helps investors better anticipate market movements and make more informed decisions.

Sentiment Analysis

Market sentiment plays a crucial role in Bitcoin’s price fluctuations. Investor psychology can lead to rapid changes in trading activity, significantly impacting Bitcoin’s price. For instance, positive news about regulatory developments or technological advancements can boost investor confidence and drive up prices.

Conversely, changes in regulations can create volatility in Bitcoin markets, affecting investor confidence and market entry. The interconnectedness of market sentiment and regulatory changes plays a pivotal role in shaping Bitcoin’s quarterly performance.

Analyzing sentiment provides insights into potential market moves, helping investors better navigate the volatile cryptocurrency landscape.

Whale Activity

Large Bitcoin holders, or whales, have a substantial impact on market dynamics, particularly when they make large trades. These whales can create significant market impacts through their trading behaviors, often causing price volatility. Their trading decisions can lead to substantial price movements, influencing overall market trends.

Understanding whale activity helps investors anticipate large market shifts and adjust their strategies accordingly. Recognizing the influence of whales is crucial for navigating the complex and often unpredictable Bitcoin market.

Future Predictions for Bitcoin Cycles

Bitcoin has shown substantial growth in value since its inception, with a cumulative increase exceeding 20 million percent. Analysts expect Bitcoin’s value to potentially reach $100,000 by the end of 2023, while others caution about market instability.

This section will provide expert opinions and scenario analyses to predict future Bitcoin cycles and their potential impacts. Understanding these predictions helps investors better prepare for future market movements and make informed investment decisions.

Expert Opinions

Halving events historically have led to significant price surges in Bitcoin due to the reduction in new supply entering the market. Rising inflation rates can lead investors to view Bitcoin as a hedge against currency devaluation.

Inflationary pressures can lead to increased interest in Bitcoin as a hedge against currency devaluation. Considering these expert opinions provides valuable insights into future market trends, helping investors better prepare for potential price movements.

Scenario Analysis

Scenario analyses suggest that Bitcoin’s price may vary widely, influenced by market trends, regulatory changes, and macroeconomic factors. In a bearish scenario, analysts warn that the cryptocurrency market might face significant downturns due to ongoing economic challenges.

On the other hand, halving events have historically led to substantial increases in Bitcoin’s price, often occurring after the supply reduction. Understanding these scenarios helps investors better manage their risk and prepare for various outcomes. This knowledge is crucial for navigating the unpredictable cryptocurrency market.

Long-Term Outlook

In the long term, Bitcoin is projected to potentially reach maximum values of around $2,103,120 by December 2032. The long-term perspective for Bitcoin suggests potential growth opportunities, heavily influenced by shifting market dynamics and investor sentiment.

Considering the long-term outlook helps investors understand the fundamental and diverse factors driving Bitcoin’s price. This understanding is essential for making informed investment decisions and capitalizing on future growth opportunities.

Summary

Understanding Bitcoin’s quarterly performance cycles is crucial for navigating its volatile market. By recognizing historical trends, key metrics, and the impact of halving events, investors can make more informed decisions. The 4-year cycle theory provides a framework for predicting future price movements, while technical analysis offers insights into potential scenarios for Q4 2025.

Macroeconomic factors, regulatory developments, and institutional adoption significantly influence Bitcoin’s price. Additionally, the behavior of Bitcoin holders, including long-term investors and whales, plays a crucial role in market dynamics. By considering expert opinions and scenario analyses, investors can better prepare for future market movements. Ultimately, a comprehensive understanding of these factors will help investors navigate the ever-evolving Bitcoin landscape and capitalize on growth opportunities.

Frequently Asked Questions

What is the 4-year cycle theory in Bitcoin?

The 4-year cycle theory suggests that Bitcoin’s price moves in a predictable pattern that aligns with halving events, which significantly reduce the supply of new bitcoins. This cycle is believed to drive price increases following these events.

How do halving events impact Bitcoin’s price?

Halving events typically lead to a reduction in the creation of new bitcoins, which historically correlates with significant price increases. This pattern suggests that upcoming halvings could create upward pressure on Bitcoin’s value.

What are the key technical indicators for analyzing Bitcoin’s performance?

The key technical indicators for analyzing Bitcoin’s performance are the Relative Strength Index (RSI), trading volume, and market capitalization. Utilizing these metrics can effectively guide traders in assessing market conditions and making informed decisions.

How do macroeconomic factors influence Bitcoin’s price?

Macroeconomic factors like inflation, interest rates, and geopolitical tensions directly impact Bitcoin’s price by influencing trading volume and investor sentiment. Understanding these dynamics is crucial for navigating the market effectively.

What role do institutional investors play in the Bitcoin market?

Institutional investors play a crucial role in the Bitcoin market by enhancing liquidity and stability, which can lead to price appreciation and increased market credibility. Their involvement, particularly through financial products like Bitcoin ETFs, broadens access to the market.