Why Institutional Confidence in Crypto Is Accelerating and What It Means for Markets

Key Takeaways

- U.S. Bitcoin ETFs attracted over $134.6 billion in assets by Q3 2025, demonstrating unprecedented institutional demand

- 83% of institutional investors plan to increase crypto allocations in 2025, driven by regulatory clarity and improved infrastructure

- Institutional adoption is reducing Bitcoin’s 30-day volatility below 80%, down from over 100% in previous cycles

- Supply compression from ETFs and corporate treasuries holding 2.2 million BTC off exchanges creates structural price support

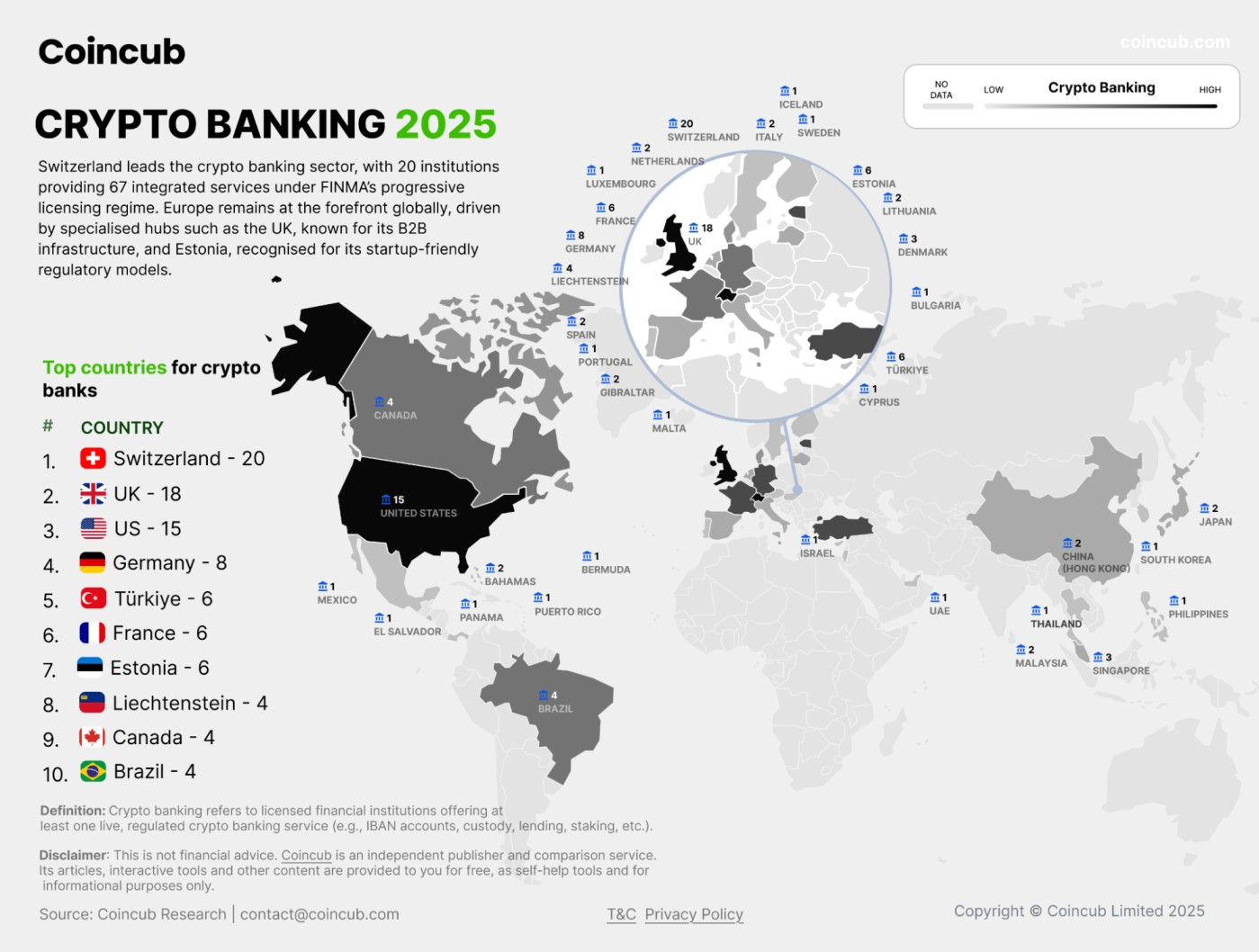

- Traditional banks like U.S. Bancorp and Goldman Sachs are restarting crypto custody services, signaling mainstream acceptance

The cryptocurrency landscape has fundamentally shifted. What was once a retail-driven speculative market has evolved into an institutional asset class attracting unprecedented levels of professional capital. By Q3 2025, U.S. spot Bitcoin ETFs alone held over $134.6 billion in assets under management, representing a seismic change in how traditional finance views digital assets.

This institutional confidence in crypto acceleration stems from multiple converging factors: regulatory frameworks providing legal certainty, infrastructure maturation addressing security concerns, and demonstrated utility beyond mere speculation. The implications extend far beyond simple price appreciation, fundamentally altering market dynamics, liquidity patterns, and the very nature of crypto asset behavior.

Understanding why institutional confidence in crypto is accelerating and what it means for markets requires examining both the catalysts driving this adoption and the structural changes reshaping cryptocurrency from a fringe technology into a core component of modern portfolio construction.

Primary Drivers Behind Accelerating Institutional Confidence

Regulatory Framework Development and Clarity

The foundation of institutional confidence rests on regulatory certainty. The Securities and Exchange Commission’s approval of spot Bitcoin ETFs in January 2024 marked a watershed moment, providing institutional investors with clear regulatory pathways to gain crypto exposure. This approval eliminated years of legal uncertainty that previously deterred risk-averse institutional money from entering digital asset markets.

The European Union’s Markets in Crypto Assets (MiCA) regulation has created a unified framework across member states, establishing comprehensive rules for crypto asset issuance, exchange operations, and custody services. This regulatory clarity removes the patchwork of conflicting national laws that previously complicated institutional investment strategies across European markets.

Beyond the U.S. and EU, jurisdictions like Hong Kong and Singapore have developed clear regulatory environments for digital assets, creating competitive advantages that attract institutional capital. These frameworks address key institutional concerns around investor protection, market manipulation prevention, and operational standards for virtual asset service providers.

The regulatory landscape shift has practical implications for institutional participation. Asset managers can now include crypto allocations in formal investment policy statements without facing regulatory uncertainty. Pension funds and insurance companies have clear guidelines for fiduciary responsibility when considering digital asset exposure. This regulatory clarity improves confidence by reducing legal and reputational risks that institutional risk management frameworks previously considered prohibitive.

Infrastructure Maturation and Security Standards

Institutional-grade custody solutions have emerged as critical enablers of professional crypto adoption. Multi-party computation (MPC) wallets and advanced cryptographic techniques now provide security standards that meet institutional requirements for safeguarding client assets. Services like Coinbase Custody offer segregated storage, insurance coverage, and audit trails that satisfy institutional compliance requirements.

The integration of crypto into existing financial infrastructure represents another crucial development. BlackRock’s integration of Bitcoin exposure into its Aladdin platform allows institutional clients to manage crypto allocations alongside traditional assets using familiar portfolio management tools. This integration eliminates the operational complexity that previously deterred institutional involvement.

Compliance automation and risk management tools have evolved to address institutional needs. Portfolio-level crypto asset management platforms now provide real-time risk monitoring, automated compliance reporting, and integration with existing institutional trading systems. These developments address operational concerns that prevented widespread institutional adoption during previous market cycles.

The maturation of trading infrastructure has also reduced institutional barriers. Prime brokerage services, algorithmic trading platforms, and institutional-grade order execution systems now provide the liquidity and execution quality that large institutions require for meaningful allocations to crypto assets.

ETF Approval and Mainstream Investment Access

Spot Bitcoin and Ethereum ETF launches eliminated direct custody and private key management requirements that posed operational challenges for traditional institutional investors. These exchange-traded products provide familiar investment vehicles that integrate seamlessly with existing institutional trading and settlement infrastructure.

The accessibility improvements extend beyond operational convenience. Pension funds, asset managers, and insurance firms can now gain crypto exposure through regulated investment companies that provide transparency, liquidity, and regulatory oversight comparable to traditional asset classes. This removes the need for specialized cryptocurrency infrastructure while maintaining institutional compliance standards.

ETF structures also address concentration risk concerns through diversified holdings and professional management. Unlike direct cryptocurrency holdings that require specialized custody arrangements, ETFs allow institutional investors to gain digital asset exposure while maintaining existing operational frameworks and risk management protocols.

The rapid growth of ETF assets under management demonstrates institutional demand for accessible crypto exposure. Leading products like the iShares Bitcoin Trust and Fidelity Wise Origin Bitcoin Fund have attracted billions in institutional capital, validating the market demand for regulated cryptocurrency investment vehicles.

Scale and Momentum of Institutional Investment

Record-Breaking ETF Inflows and AUM Growth

The numbers tell a compelling story of institutional adoption acceleration. U.S. spot Bitcoin ETFs attracted over $50 billion in institutional money by Q1 2025, demonstrating unprecedented demand from professional investors. By Q3 2025, total assets under management across these products reached $134.6 billion, with the iShares Bitcoin Trust leading at $91.06 billion and Fidelity Wise Origin maintaining $24.77 billion in assets.

These inflow patterns reveal distinct institutional participation characteristics. Unlike retail-driven rallies marked by emotional buying and selling, institutional flows demonstrate steadier accumulation patterns aligned with portfolio rebalancing cycles and strategic asset allocation decisions. The sustained nature of these inflows suggests structural rather than speculative demand.

Analysis of ETF participant data shows that institutional investors comprise the majority of large-scale ETF purchases. Asset managers, family offices, and hedge funds have systematically increased positions through these vehicles, treating Bitcoin as a portfolio diversifier rather than a speculative trading instrument.

The growth trajectory continues accelerating. Exchange-traded products holding crypto assets grew from $65 billion to over $175 billion year-over-year, representing a 169% increase that demonstrates sustained institutional interest despite market volatility concerns that typically deter conservative institutional capital.

Corporate Treasury and Hedge Fund Adoption

Corporate Bitcoin treasuries represent another institutional adoption vector, with companies holding significant cryptocurrency positions as treasury assets. These corporate holdings, combined with ETF accumulation, have removed approximately 2.2 million BTC from active trading markets, representing roughly 10% of the total Bitcoin supply locked in custodial cold wallets.

Traditional hedge funds have dramatically increased digital asset exposure, with nearly half of established hedge funds now maintaining some form of cryptocurrency allocation. Funds like Wincent and Nickel Digital have reported strong returns from crypto strategies, attracting additional institutional capital seeking alternative return sources in low-yield environments.

The hedge fund adoption pattern differs from previous cycles. Rather than launching dedicated crypto funds, established multi-strategy and macro funds are integrating digital assets into existing investment frameworks. This approach treats crypto as another asset class rather than a separate investment category, indicating mainstream acceptance within professional investment management.

Family offices have similarly increased cryptocurrency allocations, with 32% currently holding digital assets according to recent surveys. These ultra-high-net-worth family investment vehicles typically employ conservative risk management approaches, suggesting that crypto has achieved sufficient legitimacy to pass rigorous institutional due diligence processes.

Market Implications and Structural Changes

Reduced Volatility and Price Stability

Institutional participation has measurably reduced cryptocurrency market volatility. Bitcoin’s 30-day volatility has dropped below 80%, compared to previous cycles where volatility regularly exceeded 100%. This reduction reflects the influence of longer-term institutional holding strategies that smooth out short-term price fluctuations driven by retail sentiment.

Pension funds and asset managers typically employ strategic rather than tactical allocation approaches, holding positions through market cycles rather than trading based on short-term price movements. This patient capital provides a stabilizing influence that reduces the extreme boom-bust cycles characteristic of retail-dominated crypto markets.

The institutional presence has also improved market depth and liquidity quality. Large institutional trades can now be executed with reduced market impact due to deeper order books and more sophisticated market-making infrastructure serving institutional clients. This improved market structure reduces volatility spikes that previously occurred during large transactions.

Compared to traditional asset classes during their institutional adoption phases, cryptocurrency markets are following predictable maturation patterns. As institutional participation increases, volatility characteristics begin converging toward levels more compatible with traditional portfolio risk management frameworks.

Supply Dynamics and Scarcity Effects

The removal of 2.2 million BTC from active trading through ETFs and corporate treasury holdings has created structural supply constraints that influence price discovery mechanisms. Unlike previous bull markets driven primarily by retail speculation, current price dynamics reflect genuine supply-demand imbalances created by institutional accumulation.

ETF structures inherently reduce circulating supply as fund managers must purchase and hold underlying Bitcoin to back ETF shares. This supply compression effect intensifies when institutional inflows exceed new Bitcoin issuance through mining rewards, creating sustained upward pressure on prices independent of speculative trading activity.

Ethereum staking presents similar supply dynamics, with approximately 34% of total ETH supply locked in staking contracts. This mechanism removes substantial amounts of Ethereum from active trading while generating yield for institutional holders, further reducing available supply for speculative trading.

The long-term implications of these supply dynamics are significant. As institutional accumulation continues, the percentage of cryptocurrency supply available for active trading continues declining, potentially amplifying price movements during periods of increased demand or institutional reallocation.

Correlation with Traditional Markets

Bitcoin’s correlation with traditional equity markets has increased substantially, with correlation to the Nasdaq 100 reaching 0.87 in 2024. This increased correlation reflects institutional treatment of Bitcoin as a risk asset within broader portfolio allocation frameworks rather than an uncorrelated alternative investment.

The institutional treatment affects Bitcoin’s behavior during macroeconomic stress periods. When institutional investors reduce risk across portfolios, they typically decrease exposure to volatile assets including both growth equities and cryptocurrency holdings. This synchronized selling creates higher correlations during market stress periods.

However, the correlation increase also indicates Bitcoin’s integration into mainstream financial markets. As cryptocurrency becomes a standard portfolio component, its price movements increasingly reflect institutional capital allocation decisions driven by macroeconomic factors, interest rate expectations, and risk management requirements.

The implications for portfolio diversification are mixed. While higher correlations reduce Bitcoin’s effectiveness as an uncorrelated diversifier, the institutional adoption process may eventually lead to more stable, predictable risk-return characteristics that better serve traditional portfolio construction objectives.

Types of Institutional Players and Their Strategies

Traditional Banks and Financial Services

U.S. Bancorp’s decision to restart Bitcoin custody services exemplifies how traditional banking institutions are reversing previous skeptical positions toward cryptocurrency. This shift reflects improved regulatory clarity and institutional client demand for comprehensive digital asset services integrated with traditional banking relationships.

Goldman Sachs has expanded crypto trading operations, now offering Bitcoin and Ethereum derivatives to institutional clients. The investment bank’s approach focuses on providing sophisticated trading tools and risk management capabilities that institutional clients require for managing cryptocurrency exposure within broader trading strategies.

BNY Mellon launched a comprehensive digital asset custody platform targeting institutional clients who require bank-level security and regulatory oversight for cryptocurrency holdings. The platform integrates digital asset custody with traditional securities services, allowing institutional clients to manage diverse portfolios through a single trusted relationship.

These traditional financial institutions bring established compliance frameworks, institutional relationships, and operational scale that crypto-native companies cannot easily replicate. Their entry validates cryptocurrency as a legitimate asset class while providing institutional clients with familiar counterparties for digital asset services.

Asset Managers and Family Offices

Family office adoption patterns reveal sophisticated institutional approaches to cryptocurrency allocation. Approximately 32% of family offices currently hold digital assets, with allocation strategies focusing on risk management and principal protection rather than speculative returns.

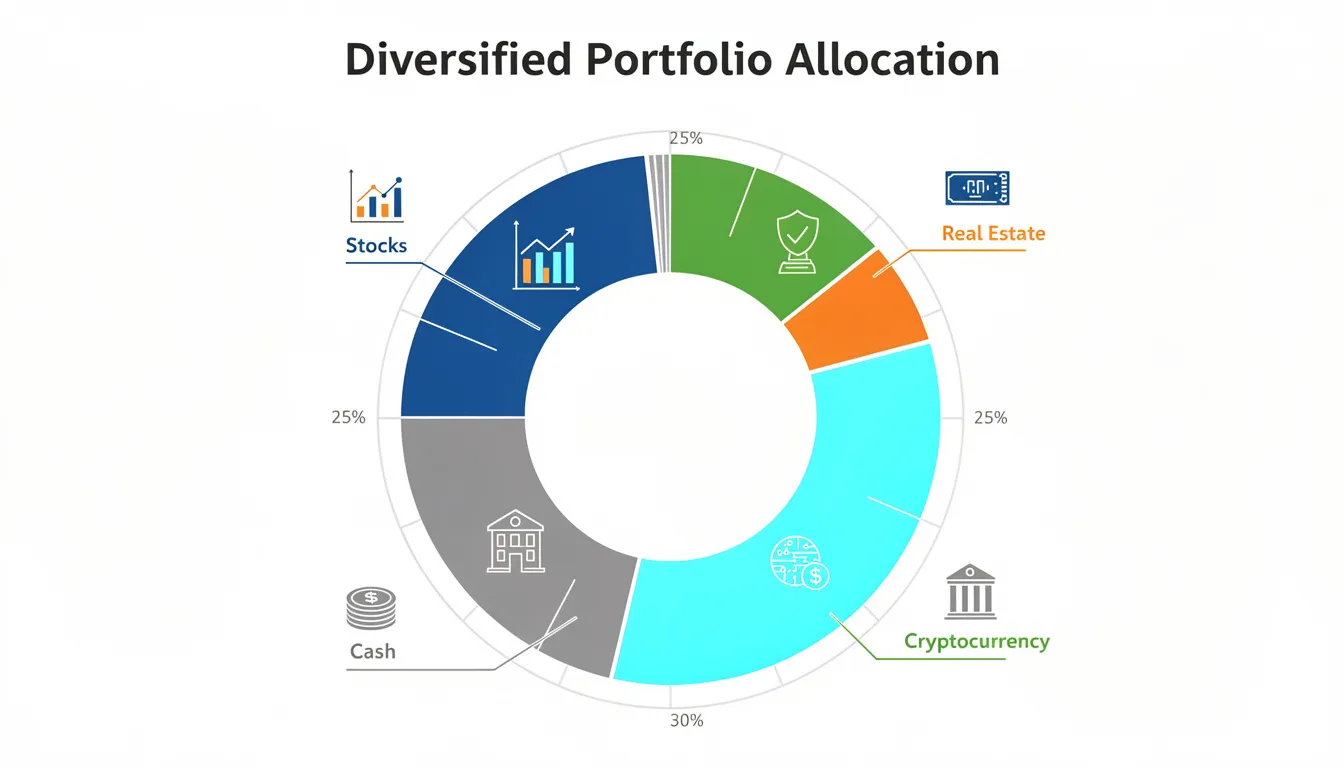

Asset managers employ structured approaches that integrate cryptocurrency within existing portfolio construction frameworks. Typical allocations range from 1-5% of total portfolio value, designed to provide upside exposure while limiting downside risk to acceptable levels for conservative institutional mandates.

The risk management approaches employed by family offices differ significantly from retail investment strategies. These sophisticated investors utilize options strategies, structured products, and diversified cryptocurrency exposures to manage volatility while maintaining strategic allocations to benefit from long-term digital asset appreciation.

Ultra-high-net-worth individuals served by family offices demonstrate higher risk tolerance compared to institutional pension fund allocations, often accepting 5-10% portfolio allocations to cryptocurrency. This difference reflects varying risk constraints between fiduciary institutional mandates and private wealth objectives.

Future Market Outlook and Implications

Tokenization and Infrastructure Development

The growing institutional focus on tokenized securities and real-world assets represents the next phase of cryptocurrency market evolution. Tokenization of traditional financial instruments provides familiar investment opportunities while leveraging blockchain infrastructure advantages including faster settlement and enhanced transparency.

Blockchain infrastructure development specifically targets institutional use cases, with platforms designed to support complex financial instruments, regulatory reporting requirements, and integration with existing financial market infrastructure. This development creates opportunities for institutional investors to participate in decentralized finance while maintaining compliance with traditional regulatory frameworks.

The convergence of decentralized finance and traditional finance creates new investment opportunities for institutional capital. Yield farming strategies, automated market making, and programmable financial instruments provide sophisticated institutional investors with alternative return sources while maintaining appropriate risk management controls.

Payment system integration initiatives like the Visa-Circle USDC partnership on Solana demonstrate how cryptocurrency infrastructure increasingly serves mainstream financial applications. These developments create practical utility that supports long-term institutional investment thesis beyond speculative price appreciation.

Concentration Risks and Market Structure Changes

The concentration of Bitcoin ownership among relatively few large institutional entities creates potential systemic risks that require careful monitoring. Large position unwinds by major institutional holders could trigger significant market disruptions that affect the broader cryptocurrency ecosystem.

Enhanced liquidity monitoring and custody transparency requirements may emerge as regulatory responses to concentrated institutional holdings. These developments could improve market stability while ensuring that large institutional positions do not pose systemic risks to broader financial markets.

The need for sophisticated risk management frameworks increases as institutional participation grows. Traditional financial risk models may prove inadequate for managing cryptocurrency exposure, requiring development of specialized tools and methodologies for institutional digital asset risk management.

Regulatory considerations for concentrated institutional holdings include potential position limits, disclosure requirements, and coordination mechanisms to prevent destabilizing liquidations during market stress periods. These regulatory developments will likely influence future institutional adoption patterns and investment strategies.

The transformation of cryptocurrency markets through institutional adoption represents a fundamental shift from speculative retail markets toward professional asset management frameworks. This evolution brings improved market stability, deeper liquidity, and integration with traditional financial infrastructure while creating new considerations around concentration risk and market structure.

The data clearly demonstrates that institutional confidence in crypto acceleration is driven by concrete improvements in regulatory clarity, infrastructure security, and investment accessibility rather than speculative enthusiasm. As these trends continue, cryptocurrency markets are likely to exhibit characteristics increasingly similar to traditional asset classes while maintaining unique properties that justify portfolio allocation.

Understanding these dynamics is crucial for all market participants, whether institutional investors evaluating allocation strategies, retail investors adapting to changing market conditions, or policymakers developing appropriate regulatory frameworks for an increasingly institutionalized cryptocurrency market.

FAQ

Why are institutions suddenly interested in crypto after years of skepticism?

The shift isn’t sudden but reflects years of infrastructure development and regulatory progress culminating in 2024-2025. Key factors include SEC approval of spot Bitcoin ETFs, improved custody solutions meeting institutional security standards, and regulatory frameworks like MiCA providing legal clarity. Additionally, demonstrated utility through stablecoins for payments and settlement has moved crypto beyond pure speculation toward practical financial applications that institutions can justify to stakeholders.

How do institutional crypto strategies differ from retail investor approaches?

Institutional investors typically employ structured risk management approaches with small strategic allocations (1-5% of portfolios) focused on long-term diversification rather than speculative trading. They use sophisticated instruments like options strategies and structured products to manage volatility, integrate crypto within existing portfolio construction frameworks, and maintain positions through market cycles rather than tactical trading. Family offices and asset managers also employ professional custody solutions and compliance frameworks that retail investors typically cannot access.

What are the main risks institutions face when investing in cryptocurrencies?

Primary institutional risks include counterparty risk from custody providers and exchanges, regulatory uncertainty that could affect legal status or operational requirements, operational complexity around private key management and compliance reporting, and concentration risk from limited numbers of major institutional counterparties. Market volatility, while declining, remains higher than traditional asset classes, and correlation with equity markets during stress periods reduces diversification benefits that institutions seek.

Could institutional selling trigger a major crypto market crash?

Concentrated institutional holdings do create systemic risk potential, particularly with approximately 2.2 million BTC (10% of supply) held by ETFs and corporate treasuries. Large institutional liquidations during market stress could trigger significant price declines amplified by reduced circulating supply. However, institutional selling typically occurs gradually through structured processes rather than panic selling, and regulatory oversight of major institutional holders may provide safeguards against destabilizing liquidations.

How does the current institutional adoption compare to previous crypto bull markets?

Current adoption is fundamentally different from previous retail-driven cycles. While 2017 and 2021 bull markets were characterized by retail speculation and emotional buying, 2024-2025 institutional adoption shows steady accumulation patterns aligned with strategic asset allocation decisions. Bitcoin volatility has decreased below 80% compared to previous 100%+ levels, institutional flows demonstrate sustained growth rather than boom-bust cycles, and regulatory approval of ETFs provides legitimate investment vehicles that didn’t exist in previous cycles.