AI Tokens vs AI Stocks: Where’s the Real Alpha for the Next Bull Run?

Wondering where to find the best returns for the next bull run in AI investments? This article compares AI tokens vs AI stocks—where’s the real alpha for the next bull run? Understand the potential returns, risks, and market dynamics of each option.

Key Takeaways

- AI tokens and AI stocks represent distinct asset classes, with tokens being digital assets and stocks representing ownership in companies, each influenced by different market dynamics.

- Market trends, including regulatory changes and technological advancements, significantly shape the performance and growth potential of AI investments, necessitating informed decision-making by investors.

- Investors are advised to diversify their portfolios and employ long-term strategies, such as dollar-cost averaging and utilizing AI tools for better asset selection, to mitigate risks and enhance returns.

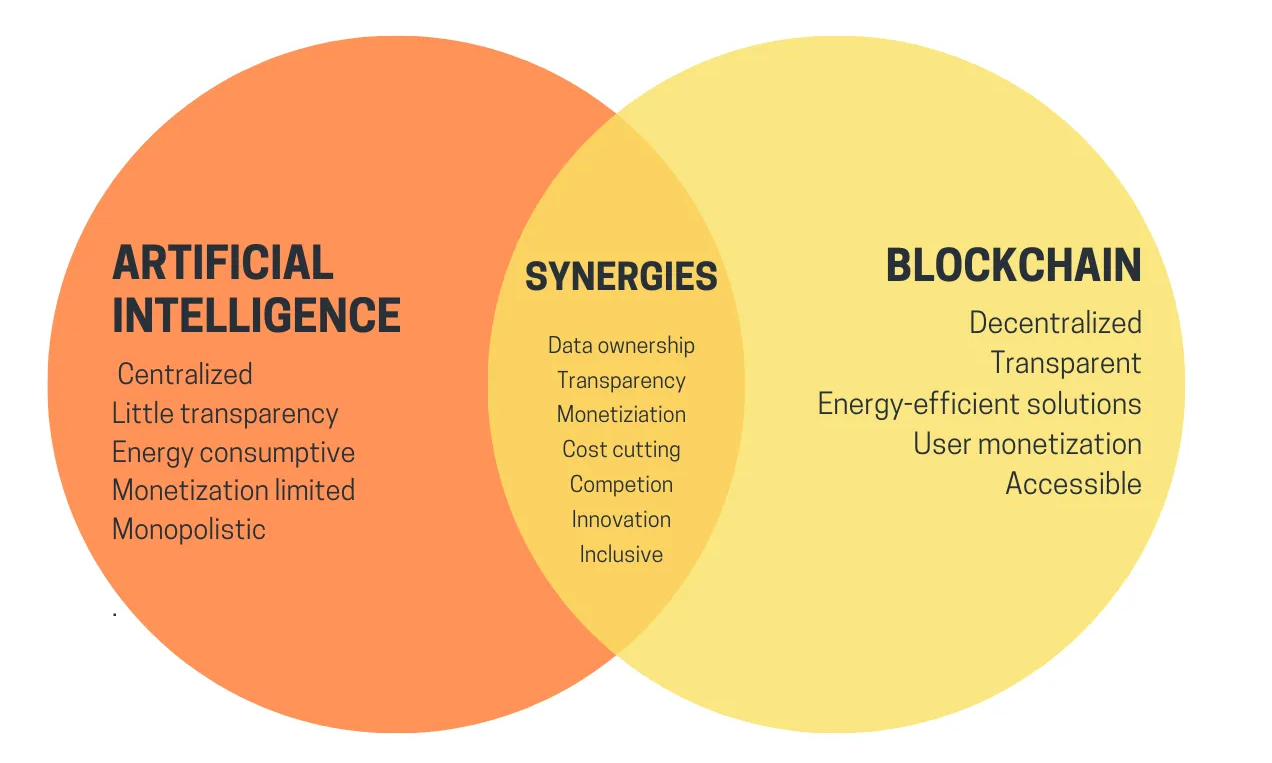

Understanding AI Tokens and AI Stocks

AI tokens, often represented by cryptocurrencies like Ethereum (ETH), have garnered attention due to their unique position in the digital assets market. Unlike traditional stocks, AI tokens are digital representations of value used within specific protocols or platforms. For instance, Ethereum’s significant market cap of approximately 3,603.62 USDT underscores its prominence in the crypto space. These tokens have generated demand through financial products like ETFs, which improve overall market interest and drive investment trends. Additionally, the rise of digital assets has led to increased interest in various coins.

On the other hand, AI stocks represent equity in companies involved in AI technology. These are traditional financial instruments that offer investors a share of ownership in a company. The fundamental difference between AI tokens and AI stocks lies in their asset class—tokens are digital assets, while stocks are equities. This distinction is crucial as it influences the factors that drive their value and performance.

The growing interest in AI assets, be it tokens or stocks, is shaping the future of financial instruments. Investors are increasingly drawn to these securities due to their potential for high returns and their role in advancing technological innovation. This rising interest is pivotal, significantly influencing market developments and trade investment trends.

Market Trends Shaping AI Investments

Navigating the AI investment landscape requires a keen understanding of the market trends that shape it. Regulatory developments and macroeconomic factors are crucial for assessing the sustainability of the bull run in the AI market. Recent U.S. elections have ushered in a pro-crypto political climate, positively influencing investor sentiment. The current administration’s stance on cryptocurrencies signals an encouraging environment for AI investments.

Technological advancements, such as institutional adoption of AI and crypto technologies, have also played a significant role in driving market trends. These advancements not only enhance the functionality and appeal of AI tokens but also boost the operational efficiencies of companies involved in AI, thereby influencing their stock performance.

Potential catalysts for a bull run in the cryptocurrency market include ETF inflows and favorable regulations. As U.S. states push back against Bitcoin reserve resolutions to hedge against economic uncertainties, the focus shifts to asset appreciation. Investors must remain informed about these market trends, technological developments, and regulatory changes to navigate the major bull runs in the AI investment landscape effectively.

However, it is essential to remember that the inherent volatility in the crypto landscape poses significant challenges for the security of the crypto industry. Investors need to be prepared for rapid fluctuations in the crypto market and adjust their strategies accordingly to mitigate risks and capitalize on opportunities.

Comparing Growth Potential: AI Tokens vs. AI Stocks

When it comes to growth potential, both AI tokens and AI stocks offer promising avenues, albeit with different risk profiles and dynamics. Analysts predict that the gap between high-performing AI firms and those lagging behind will widen, significantly affecting investment returns. This divergence presents both opportunities and challenges for investors.

AI tokens, often influenced by technological advancements and market sentiment, can experience rapid price appreciation. Conversely, AI stocks, backed by tangible company performance and earnings, offer a more stable but potentially slower growth trajectory. Understanding these dynamics is crucial for investors aiming to maximize returns in the AI sector.

Key Factors Driving AI Token Prices

Several key factors drive the prices of AI tokens, making them a dynamic and often volatile investment. The rise in Maple Finance’s token (MPL) price can be attributed to the protocol’s rapid profitability achieved just nine months post-launch, along with expanded utility through xMPL. This demonstrates how quickly successful protocols can gain traction and drive token prices.

Investor sentiment plays a significant role in the AI token sector. A mix of optimism about potential growth and caution due to inherent risks influences price movements. For example, the substantial price increase of SAND was partly triggered by Facebook’s rebranding to Meta, which ignited interest in metaverse-related tokens.

Demand for computational resources is another critical factor. Decentralized GPU leasing platforms are emerging as a viable use case for AI tokens, driven by the growing need for computational power in AI applications. This demand can significantly impact token prices, reflecting the broader adoption of AI technologies.

Key Factors Influencing AI Stock Performance

AI stocks are influenced by a variety of factors that determine their market performance. Company earnings are paramount, as they directly reflect a company’s financial health and operational efficiency. Market analysts foresee that companies successfully adopting AI may see their stock prices soar due to enhanced operational efficiencies.

Economic growth also plays a vital role in AI stock performance. As economies expand, companies can invest more in AI technologies, driving innovation and, consequently, stock prices. For instance, Nvidia’s earnings can significantly impact the market for AI tokens, often leading to price fluctuations.

Innovation within the AI sector is another critical driver. Companies that continuously innovate and adopt new technologies are likely to outperform their peers, attracting more investors and driving stock prices higher. This underscores the importance of staying abreast of technological advancements and supply market trends.

Risk Assessment: AI Tokens vs. AI Stocks

Investing in AI tokens and AI stocks comes with its own set of risks, which investors must carefully assess. AI tokens present higher volatility compared to AI stocks due to rapid market fluctuations. The lack of historical data on AI tokens further contributes to greater uncertainty in risk assessments compared to established AI stocks.

Regulatory challenges for AI tokens are often more intense and evolving than for traditional AI stocks. This regulatory environment can impact the acceptance and success of AI tokens, posing additional risks. Moreover, market manipulation risks are more prevalent in the AI token space compared to traditional stocks.

On the other hand, AI stocks are generally perceived as safer investments. Established companies with stable revenue streams offer a more secure investment option. However, macroeconomic conditions, including interest rates and liquidity, play a crucial role in the performance of both AI tokens and stocks. Investors need to consider these factors to make informed decisions.

Long-Term Investment Strategies

For long-term AI investments, having a solid strategy is crucial. Dollar-cost averaging (DCA) into quality digital assets is a recommended approach because:

- It helps mitigate the impact of market volatility.

- It involves regularly investing a fixed amount of money, regardless of market conditions.

- This leads to stable long-term returns.

Diversification is another effective strategy. Spreading investments into blue-chip assets and promising altcoins can reduce risk and enhance returns. This approach ensures that investors are not overly exposed to a single asset’s performance, which can be particularly volatile in the AI token market.

Due diligence is paramount when investing in AI human assets. Investors should thoroughly research projects before completing funds, verify the project’s fundamentals and potential for growth. Additionally, proceeding with a sense of responsibility to stay informed about market trends, regulatory shifts, and economic growth can help investors make better decisions and adapt their strategies accordingly. A review of these factors is essential for success.

Finally, maintaining liquidity and being prepared for market fluctuations is essential. Retail investors and trading traders should ensure they have enough liquidity to respond to market changes and take advantage of opportunities as they arise. This proactive approach can help mitigate significant losses and maximize rewards over time, creating a strong connection to potential gains.

Analyst Predictions for AI Investments

Analysts have provided various predictions for the future of AI investments, offering valuable insights for investors. Most analysts indicate a significant potential for AI tokens to experience substantial price increases in the coming years. The impending crypto bull market is expected to influence the valuation of various AI-related assets.

For instance, some analysts predict that Ethereum could reach $10,000 or more by 2030. These predictions are based on the potential gains from increased adoption of AI technologies and the overall hype surrounding the sector. Investors should consider these forecasts when planning their investment strategies to capitalize on potential price action during the next bull run.

However, it is essential to approach these predictions with a balanced perspective. While the potential for high returns is enticing, the inherent risks and volatility in the AI market should not be overlooked. Investors should use these predictions as part of a broader strategy that includes thorough research, risk management, and the possibility of high returns.

Case Studies: Successful AI Token and Stock Investments

Real-world examples of successful AI investments can provide valuable lessons and insights. The utility token SAND of The Sandbox achieved a remarkable price increase from $0.66 to $8.40 within two months, representing a twelvefold growth. This success story highlights the potential for substantial returns in the AI token market.

Maple Finance’s governance token MPL also saw significant price appreciation, hitting an all-time high of $64, up from initial sales priced between $0.50 and $5. This example underscores the importance of raising promising projects early and holding on to them as they grow.

Another notable case is CVX, the token for Convex Finance, which rose from around $6.60 to $50 during a bullish market phase, driven by strong demand from liquidity providers. These examples illustrate the substantial returns and market growth potential within the AI token sector, offering valuable insights for investors looking to capitalize on the next bull run.

How to Diversify Your AI Investment Portfolio

Diversification is key to managing risk and enhancing long-term returns in AI investments. Effective diversification involves spreading assets across various classes, sectors, and regions. This approach ensures that investors are not overly exposed to a single asset’s performance, which can be particularly volatile in the AI market.

AI tools can assist investors in making better asset selections for their portfolios, improving diversification strategies. Earlier, these tools can analyze market trends, predict potential gains, and recommend optimal asset allocations.

Investors should consider using pooled exchange-traded funds (ETFs) that focus on AI to achieve diversified exposure. Additionally, regular rebalancing and continuous monitoring of the portfolio are essential to maintain the desired asset allocation and adapt to changing market conditions.

Summary

In summary, AI tokens and AI stocks offer unique investment opportunities with different risk profiles and growth potentials. Understanding the factors driving their performance, staying informed about market trends, and employing effective investment strategies are crucial for maximizing returns and minimizing risks.

As the AI market evolves, investors who stay proactive and adaptable are likely to reap the rewards. By diversifying their portfolios, conducting thorough research, and leveraging the insights provided in this guide, investors can navigate the exciting world of AI investments with confidence and foresight.

Frequently Asked Questions

What are the main differences between AI tokens and AI stocks?

AI tokens are digital currencies tied to specific platforms, whereas AI stocks offer ownership stakes in companies developing AI technologies. This distinction impacts how you invest in and utilize these assets.

What factors drive the price of AI tokens?

The price of AI tokens is primarily driven by protocol profitability, investor sentiment, demand for computational resources, and significant events, such as rebranding. Understanding these factors can help you better navigate the market.

How can I mitigate risks when investing in AI assets?

To mitigate risks when investing in AI assets, focus on diversification, implement dollar-cost averaging, conduct thorough research, and stay updated on market trends and regulatory changes. This strategy will help safeguard your investments effectively.

What are some successful examples of AI token investments?

Successful examples of AI token investments include SAND, which experienced a twelvefold price increase, and MPL, which also appreciated significantly from its initial sales prices. These investments highlight the potential for substantial returns in the AI token market.

What are analysts predicting for the future of AI investments?

Analysts are optimistic about AI investments, projecting significant price increases for AI tokens, with Ethereum potentially reaching $10,000 or more by 2030. This suggests a strong growth trajectory in the AI sector.